Value at risk is a calculation that estimates the possible loss on investments. This calculation calculates the possible loss on an investment over a single day. This calculation can be adjusted to take into account market volatility. This calculation is essential for all investors in stocks or bonds. It can help you decide which investments are the best for you based on your risk tolerance and goals. Also, you can use the value at risk calculation to plan your retirement strategy.

Probability to lose a certain sum depending on how much is being risked

When we invest, we use probabilities to determine the odds of success. A $10,000 investment in stocks would result in a 12% loss of that money. Peril is the amount of money you lose in case your investment fails. For example, we could lose $5,000 on an investment and suffer $4000 of damage. It is important that you remember that success does not always come with a guarantee.

Calculation of VaR

To determine the level of risk associated with any investment, value at Risk is an important tool. Based on past performance, value at risk is the probability that you will lose money. It also considers current market conditions. The calculation can be used to determine the average loss in a given portfolio. Simple calculation of value at risk. The portfolio's expected loss in 5% is the percentage value.

Monte Carlo method

The Monte Carlo method is a common tool in financial risk management. It is flexible, which allows for a broad range of scenarios and is therefore one of most powerful VAR strategies. Simulators can account for complex pricing patterns and nonlinear exposures. This method can also be used to develop more complicated models and measure risk. There are however limitations to this method.

Historical method

The Historical method to value at risk (VaR), is a popular investment strategy. It uses historical data for estimating risk factors, then applies the data to current market price. It is an intuitive and simple way to calculate VaR. This corresponds to the maximum loss over a specific period. It is important that you note that the accuracy of a VaR calculation depends on how many correct data points are used. To maximize accuracy, it is essential to capture market changes such as major crises.

Liquidity effects of VaR

Valuation at risk (or VaR) is a measure for the asset's riskiness. It is calculated by dividing the asset's expected future value by its current value. It is the most popular measure of risk for financial institutions. It is based on a mathematical model that emphasizes rare events. The risk distribution can be parametric. This means that the mass of the distribution is at the mean and the tails are at a low point. In the FTSE, there are five such days within a 25 years period.

FAQ

What is the difference between TQM and Six Sigma?

The key difference between the two quality management tools is that while six-sigma focuses its efforts on eliminating defects, total quality management (TQM), focuses more on improving processes and reducing cost.

Six Sigma can be described as a strategy for continuous improvement. It emphasizes the elimination and improvement of defects using statistical methods, such as control charts, P-charts and Pareto analysis.

This method has the goal to reduce variation of product output. This is done by identifying and correcting the root causes of problems.

Total quality management refers to the monitoring and measurement of all aspects in an organization. It also involves training employees to improve performance.

It is commonly used as a strategy for increasing productivity.

How does Six Sigma work

Six Sigma uses statistical analysis to find problems, measure them, analyze root causes, correct problems, and learn from experience.

The first step in solving a problem is to identify it.

The data is then analyzed and collected to identify trends.

Next, corrective steps are taken to fix the problem.

Finally, data is reanalyzed to determine whether the problem has been eliminated.

This continues until you solve the problem.

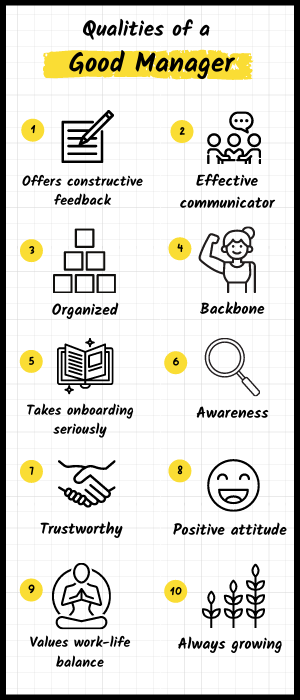

What role does a manager play in a company?

There are many roles that a manager can play in different industries.

Managers generally oversee the day-today operations of a business.

He/she is responsible for ensuring that the company meets all its financial obligations and produces the goods or services customers want.

He/she is responsible for ensuring that employees comply with all regulations and follow quality standards.

He/she designs new products or services and manages marketing campaigns.

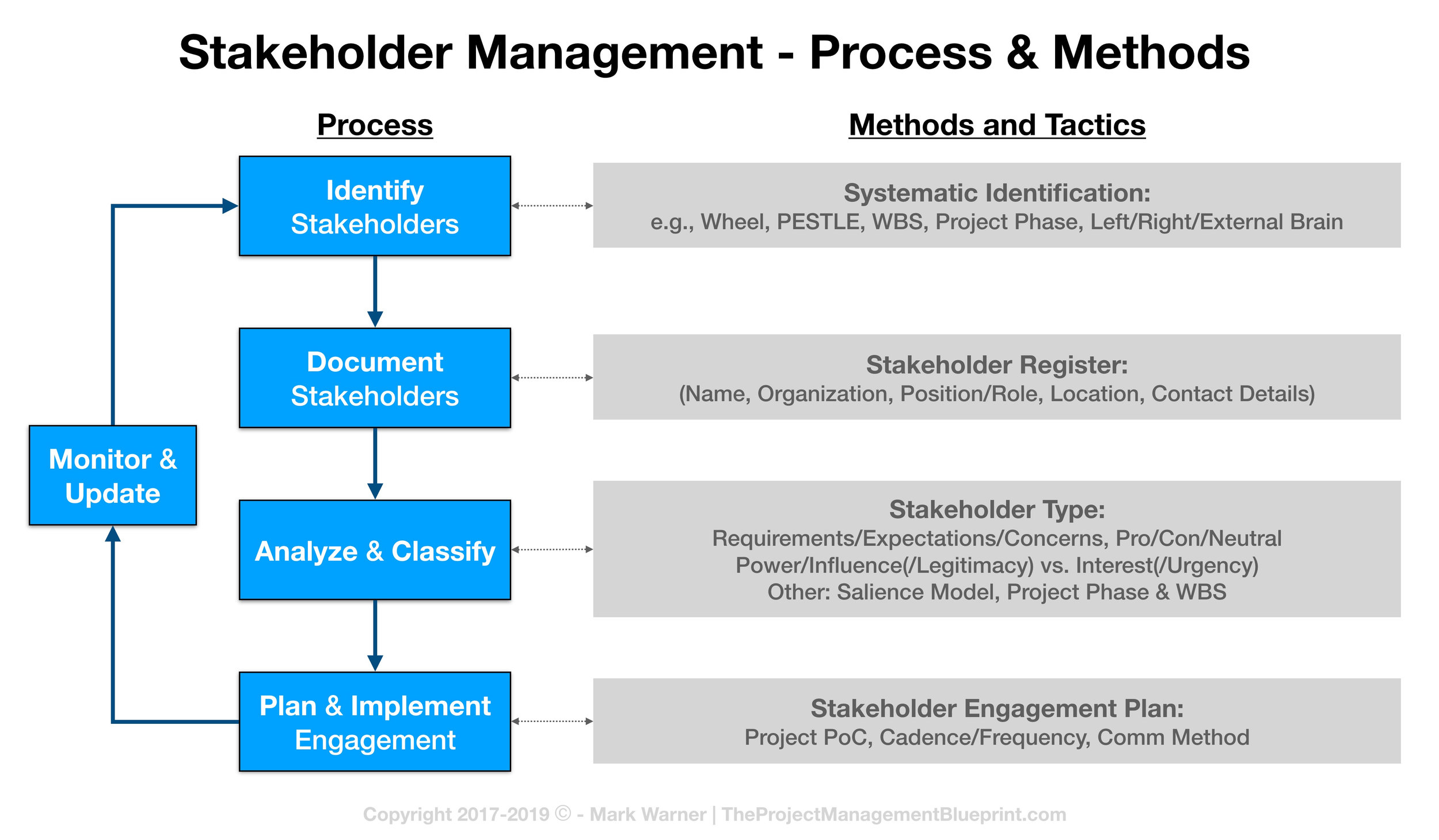

What are the 4 main functions of management?

Management is responsible for planning, organizing, directing, and controlling people and resources. It includes creating policies and procedures, as well setting goals.

Organizations can achieve their goals through management. This includes leadership, coordination, control and motivation.

Management has four primary functions:

Planning - Planning is about determining what must be done.

Organizing - Organizing involves deciding how things should be done.

Directing - Directing means getting people to follow instructions.

Controlling: Controlling refers to making sure that people do what they are supposed to.

What are the five management methods?

Each business has five stages: planning, execution and monitoring.

Setting goals for the future requires planning. It involves setting goals and making plans.

Execution happens when you actually do the plan. You need to make sure they're followed by everyone involved.

Monitoring is checking on progress towards achieving your objectives. Regular reviews of performance against targets, budgets, and other goals should be part.

Each year, reviews are held at the end. They allow for an assessment of whether all went well throughout the year. If not then, you can make changes to improve your performance next year.

After each year's review, evaluation occurs. It helps to determine what worked and what didn’t. It also provides feedback on how well people performed.

Statistics

- This field is expected to grow about 7% by 2028, a bit faster than the national average for job growth. (wgu.edu)

- UpCounsel accepts only the top 5 percent of lawyers on its site. (upcounsel.com)

- Hire the top business lawyers and save up to 60% on legal fees (upcounsel.com)

- The profession is expected to grow 7% by 2028, a bit faster than the national average. (wgu.edu)

- 100% of the courses are offered online, and no campus visits are required — a big time-saver for you. (online.uc.edu)

External Links

How To

How do I get my Six Sigma license?

Six Sigma is a quality control tool that improves processes and increases efficiency. Six Sigma is a method that helps companies get consistent results from their operations. The name is derived from the Greek word "sigmas", which means "six". This process was developed at Motorola in 1986. Motorola recognized that they had to standardize their manufacturing processes to produce faster and more affordable products. The many people involved in manufacturing had caused problems with consistency. To resolve this issue, they used statistical tools like Pareto analysis and control charts. These techniques would be applied to every aspect of the operation. They would then be able make improvements where needed. When you are trying to obtain your Six Sigma certification, there are three steps. First, you need to determine if your qualifications are valid. Before you take any exams, you'll need to take some classes. Once you pass those classes, the test will begin. You'll need to go back and review all the information you received in class. Next, you'll be ready for the test. You'll be certified if your test passes. Finally, you can add your certifications on to your resume.